FINRA and Social Media: 7 Tips to Stay Compliant

FINRA is the Financial Industry Regulatory Authority. It’s a not-for-profit organization authorized by the U.S. government to oversee broker-dealers in the United States. They operate under the oversight of the Securities and Exchange Commission (SEC).

FINRA’s overarching goals are to protect investors and ensure market integrity. The FINRA social media goals are the same. Part of their role is to ensure that ads for investment products are truthful and not misleading. They also oversee disclosure and recordkeeping requirements for investment products.

Grow your client base with the tool that makes it easy to sell, engage, measure, and win — all while staying compliant.

Book a DemoWhat does FINRA say about social media?

FINRA first started issuing guidance specific to social media way back in 2010. That’s when social networking was still in its infancy.

Thirteen years later, FINRA has quite a lot to say about social media. That’s not surprising. Their research shows social media has become the top source of investing information for Gen Z investors. Almost half of millennials and more than a quarter of Gen X also rely on social to learn about investing.

Source: FINRA Investor Education Foundation and CFA Institute

FINRA rules apply to social media like any other communications medium. As FINRA puts it:

“Social media may be a new medium, but FINRA’s rules on communicating with the public are still applicable.”

Throughout this post, we’ll explore what that looks like in practice for financial institutions that communicate with customers through social media.

Common FINRA risks and violations on social media

Here are some of the most common ways to run afoul of FINRA regulations on social media.

Not archiving client and prospect communications

FINRA requires you to archive communications related to “business as such” for at least three years. FINRA social media archiving is no different.

This can get tricky if brokers use individual accounts for business purposes. Sure, you have archiving set up on your corporate channels. But do you have an archive of communications through these individual accounts?

Keep in mind that the archiving requirements extend beyond direct messaging. They also apply to public comments on your social channels.

Lack of appropriate supervision/approval by a principal

A registered principal must review firm social media accounts before use. This includes accounts managed by individual representatives and brokers.

All static content on social channels must be approved by a registered principal before posting. Interactive content must be monitored for compliance.

What’s the difference between static and interactive communications? Static content stays online for the long term. Interactive communication happens in real time. For example, a social post is static, but responding to comments on that post is interactive.

More suitability rules apply to interactive communication that recommends specific products. Either:

- A registered principal must approve the recommendation in advance, or

- The recommendation must conform to an approved template.

You must keep records of these approvals.

Handling comments posted on social channels

You need to track comments on your social channels. Look for complaints, instructions, or any other communications that need review. These comments are subject to the same timeframe requirements as any other communications.

You don’t need to do anything about comments with positive feedback about your firm. That is, unless you like or reply to them or share them. In that case, you have “adopted” the comments. So, you need to provide testimonial disclosures. You can do so through a clearly labeled link.

Linking to third-party websites

Curated content is a great way to round out your social media content calendar. But you need to be careful about what you share. Consider FINRA Regulatory Notice 11-39. It prohibits firms from linking to sites that contain “false or misleading content.”

Regulatory Notice 17-18 further clarifies:

“By sharing or linking to specific content, the firm has adopted the content and would be responsible for ensuring that, when read in context with the statements in the originating post, the content complies with the same standards as communications created by, or on behalf of, the firm.”

Thinking about sharing a link to a resource on a third-party site? First, do an extensive review of the site to make sure it provides only credible information.

Working with influencers

Investment firms can work with social media influencers and referral programs. But they have to be particularly rigorous in screening influencers.

Before working with an influencer, review their existing social content. Check for anything that violates compliance requirements or creates reputational risk.

Once you establish a relationship with an influencer, you need to make sure they are well trained. Put supervisory procedures in place. You also need to maintain records of their communications related to your business. That includes public comments as well as DMs.

This is a lot more oversight than many influencers usually get. So, they may bristle at these requirements. If they’re not willing to work with you to follow FINRA guidelines, they are not a good fit for your business.

According to FINRA, social media influencers’ posts and comments need to be labeled as ads. Regulatory Notice 17-18 states:

“Firms should clearly identify as advertisements any communications that take the form of comments or posts by influencers and include the broker-dealer’s name as well as any other information required for compliance with Rule 2210.”

Making inappropriate claims

Social media may seem like a casual platform for interacting with prospective clients. But social media content still needs to follow the content standards in FINRA Rule 2210 on Communications with the Public.

Some of the FINRA rule 2210 social media expectations are:

- Social content must be balanced and complete.

- You cannot make false or exaggerated claims.

- You can’t predict or project performance.

What are the consequences of FINRA violations on social media?

FINRA social media violations are dealt with through an enforcement process.

Source: FINRA

Disciplinary action can range from the issuance of a Cautionary Action all the way up to being barred from the brokerage industry. (The latter applies only in cases of serious misconduct.) Other sanctions include fines and suspensions.

Here are the potential individual sanctions for approval, review, recordkeeping, and filing violations.

Source: FINRA Sanctions Guidelines

For firms, the same violations can result in fines of $5,000 to $80,000.

Source: FINRA Sanctions Guidelines

Of course, as noted above, these are not the only potential ways to violate FINRA regulations on social media. Here’s a real-world disciplinary example.

In December 2022, FINRA disciplined a General Securities Representative. They fined him $5,000 and suspended him for 10 business days because of a series of posts on his public Facebook Page.

FINRA cited the text of some of these posts in its decision. Here’s one example:

“Good afternoon all, I’m extremely pleased to announce Our monthly performance for September 2019 . [Hedge Fund A] took 3rd place for an options hedge fund with a monthly return of 2.79%. and with that, we are currently the TOP performing options strategy hedge Fund on the street. Our 2019 YTD return of 35.38% is over 100% higher than the second best performing options fund as we have beat the S&P every year since our 2015 inception! Who has your best interests in mind,? WE DO!”

FINRA found that the representative violated three FINRA Rules because the posts:

- Made claims about performance without enough facts to evaluate the claims;

- Were often options-related but didn’t have the appropriate disclosures; and

- Were not reviewed by a firm principal or submitted to FINRA’s Advertising Regulation Department.

How to build a FINRA-compliant social media presence

It might all sound overwhelming. But if you have the proper procedures in place, you can help keep your company in line with the FINRA rules on social media.

1. Understand the regulations

As you’ve seen, quite a few FINRA rules and regulations apply to social media channels.

The main topics you need to be aware of when planning your social media strategy are:

- Recordkeeping and filing requirements

- Approval, supervision, and review requirements

- Communications rules

- Rules related to testimonials, influencers, and social ads

- Rules related to adoption of/linking to third-party content

We covered the highlights earlier in this post. For an in-depth understanding of FINRA regulations on social media, study Regulatory Notice 17-18.

2. Train your team

One of the most important things for your team to understand is the difference between business and personal use of social media. Regulatory Notice 11-39 specifically notes:

“A firm’s policies and procedures must include training and education of its associated persons regarding the differences between business and nonbusiness communications and the measures required to ensure that any business communication made by associated persons is retained, retrievable and supervised.”

The Sanctions Guidelines also identify “adequate training and educational initiatives” as a principal consideration when determining how to deal with a violation.

Regular training on FINRA social media compliance and the latest developments on social media for financial services helps protect your brand.

3. Limit access to your social accounts

Inappropriate access to your social accounts opens your firm up to many FINRA social media violations. Those might include lack of supervision, misleading statements, or customer data breaches. There’s a lot at stake within each social account.

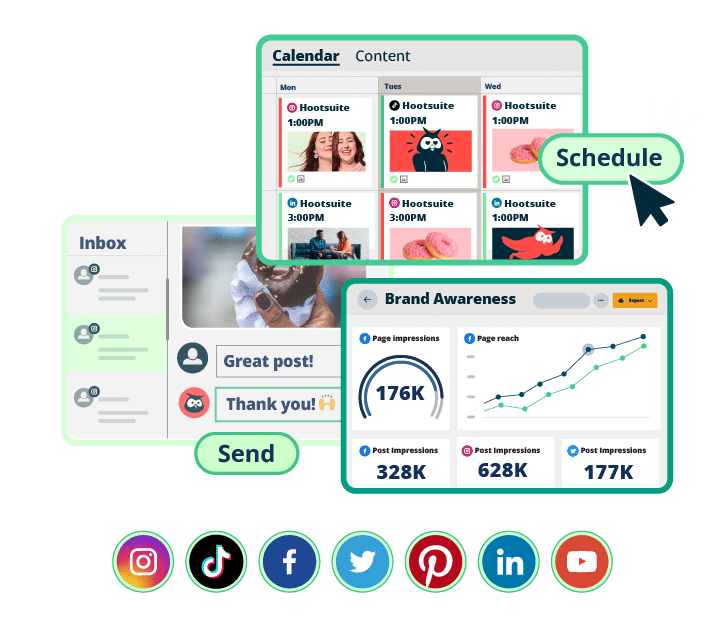

It’s not a best practice for team members to log into social platforms directly. Instead, use a social media management tool like Hootsuite to manage access and permissions within your accounts. This gives each team member the appropriate level of access for their role. It also allows you to set up an approval workflow. This ensures all social posts can get principal review before posting.

4. Create clear social media guidelines

Social media guidelines are an important document for any brand. For financial services brands, they’re critical.

As for all brands, your social media guidelines should include:

- Disclosure and transparency requirements;

- Privacy rules;

- Cyber safety guidelines;

- Guidelines on harassment and inclusivity; and

- Copyright and trademark guidelines.

Firms subject to FINRA regulations need to take things a step further. Add specific procedures for supervision, approval, and archiving.

Having a FINRA social media policy in place is a principal consideration in the Sanctions Guidelines.

Bonus: Get a free, customizable social media policy template designed specifically for banks to quickly and easily create guidelines for your financial institution.

5. Create a content library

Once your content is approved, add it to a content library. This gives your team a growing catalog of resources to use without the extensive approval requirements for new content. For example, the Suitability Rules say firms should:

“Prohibit interactive electronic communications that recommend specific products unless:

- a registered principal has previously approved the content, or

- the recommendation conforms to a previously approved template.”

In addition to a content library, you can use Hootsuite Amplify to make newly approved content available to all team members. This is especially useful for independent agents, brokers, and advisors.

6. Check content for compliance before publishing

Every social post needs to go through a compliance review before posting. But compliance experts shouldn’t waste their time addressing repetitive basic compliance issues.

Training helps reduce compliance issues before content enters the approval workflow. Another way to reduce compliance revisions is to use an automated compliance tool like ProofPoint.

Hootsuite’s ProofPoint integration automatically blocks content for compliance standards violations. It flags specific items that need revision. Your social team can then make the changes before sending the post to the compliance team for review. This frees up your compliance experts to address more complex compliance requirements. It also reduces the amount of back and forth required for each post.

7. Maintain impeccable archives and records

Here’s hoping you never have to go through a regulatory audit. But if you do, you’ll need records and archives of all your social media activity and communications.

Hootsuite integrates with solutions like Brolly to automatically archive posts, comments, and other communications. Everything goes into a searchable archive with the complete context.

Hootsuite also records your approval signoffs. You’ll have a full record of the approvals required by FINRA.

Hootsuite makes social marketing easy for financial service professionals. From a single dashboard, you can manage all your networks, drive revenue, provide customer service, mitigate risk, and stay compliant. See how the tool can work for your business.

Get more leads, engage customers and stay compliant with Hootsuite, the #1 social media tool for financial services.

Book a DemoThe post FINRA and Social Media: 7 Tips to Stay Compliant appeared first on Social Media Marketing & Management Dashboard.

Categories

- 60% of the time… (1)

- A/B Testing (2)

- Ad placements (3)

- adops (4)

- adops vs sales (5)

- AdParlor 101 (43)

- adx (1)

- algorithm (1)

- Analysis (10)

- Apple (1)

- Audience (1)

- Augmented Reality (1)

- authenticity (1)

- Automation (1)

- Back to School (1)

- best practices (2)

- brand voice (1)

- branding (1)

- Build a Blog Community (12)

- Case Study (3)

- celebrate women (1)

- certification (1)

- Collections (1)

- Community (1)

- Conference News (1)

- conferences (1)

- content (1)

- content curation (1)

- content marketing (1)

- contests (1)

- Conversion Lift Test (1)

- Conversion testing (1)

- cost control (2)

- Creative (6)

- crisis (1)

- Curation (1)

- Custom Audience Targeting (4)

- Digital Advertising (2)

- Digital Marketing (6)

- DPA (1)

- Dynamic Ad Creative (1)

- dynamic product ads (1)

- E-Commerce (1)

- eCommerce (2)

- Ecosystem (1)

- email marketing (3)

- employee advocacy program (1)

- employee advocates (1)

- engineers (1)

- event marketing (1)

- event marketing strategy (1)

- events (1)

- Experiments (29)

- F8 (2)

- Facebook (64)

- Facebook Ad Split Testing (1)

- facebook ads (18)

- Facebook Ads How To (1)

- Facebook Advertising (30)

- Facebook Audience Network (1)

- Facebook Creative Platform Partners (1)

- facebook marketing (1)

- Facebook Marketing Partners (2)

- Facebook Optimizations (1)

- Facebook Posts (1)

- facebook stories (1)

- Facebook Updates (2)

- Facebook Video Ads (1)

- Facebook Watch (1)

- fbf (11)

- first impression takeover (5)

- fito (5)

- Fluent (1)

- Get Started With Wix Blog (1)

- Google (9)

- Google Ad Products (5)

- Google Analytics (1)

- Guest Post (1)

- Guides (32)

- Halloween (1)

- holiday marketing (1)

- Holiday Season Advertising (7)

- Holiday Shopping Season (4)

- Holiday Video Ads (1)

- holidays (4)

- Hootsuite How-To (3)

- Hootsuite Life (1)

- how to (6)

- How to get Instagram followers (1)

- How to get more Instagram followers (1)

- i don't understand a single thing he is or has been saying (1)

- if you need any proof that we're all just making it up (2)

- Incrementality (1)

- influencer marketing (1)

- Infographic (1)

- Instagram (39)

- Instagram Ads (11)

- Instagram advertising (8)

- Instagram best practices (1)

- Instagram followers (1)

- Instagram Partner (1)

- Instagram Stories (2)

- Instagram tips (1)

- Instagram Video Ads (2)

- invite (1)

- Landing Page (1)

- link shorteners (1)

- LinkedIn (22)

- LinkedIn Ads (2)

- LinkedIn Advertising (2)

- LinkedIn Stats (1)

- LinkedIn Targeting (5)

- Linkedin Usage (1)

- List (1)

- listening (2)

- Lists (3)

- Livestreaming (1)

- look no further than the new yorker store (2)

- lunch (1)

- Mac (1)

- macOS (1)

- Marketing to Millennials (2)

- mental health (1)

- metaverse (2)

- Mobile App Marketing (3)

- Monetizing Pinterest (2)

- Monetizing Social Media (2)

- Monthly Updates (10)

- Mothers Day (1)

- movies for social media managers (1)

- new releases (11)

- News (79)

- News & Events (12)

- no one knows what they're doing (2)

- OnlineShopping (2)

- or ari paparo (1)

- owly shortener (1)

- Paid Media (2)

- People-Based Marketing (3)

- performance marketing (5)

- Pinterest (34)

- Pinterest Ads (11)

- Pinterest Advertising (8)

- Pinterest how to (1)

- Pinterest Tag helper (5)

- Pinterest Targeting (6)

- platform health (1)

- Platform Updates (8)

- Press Release (2)

- product catalog (1)

- Productivity (10)

- Programmatic (3)

- quick work (1)

- Reddit (3)

- reels (1)

- Reporting (1)

- Resources (30)

- ROI (1)

- rules (1)

- Seamless shopping (1)

- share of voice (1)

- Shoppable ads (4)

- short-form video (1)

- shorts (1)

- Skills (26)

- SMB (1)

- SnapChat (28)

- SnapChat Ads (8)

- SnapChat Advertising (5)

- Social (153)

- social ads (1)

- Social Advertising (14)

- social customer service (1)

- Social Fresh Tips (2)

- Social Media (5)

- social media automation (1)

- social media content calendar (1)

- social media for events (1)

- social media management (2)

- Social Media Marketing (49)

- social media monitoring (1)

- Social Media News (4)

- social media statistics (1)

- social media tracking in google analytics (1)

- social media tutorial (2)

- Social Toolkit Podcast (1)

- Social Video (5)

- stories (1)

- Strategy (776)

- terms (1)

- Testing (2)

- there are times ive found myself talking to ari and even though none of the words he is using are new to me (1)

- they've done studies (1)

- this is also true of anytime i have to talk to developers (1)

- tiktok (9)

- tools (1)

- Topics & Trends (3)

- Trend (12)

- Twitter (15)

- Twitter Ads (5)

- Twitter Advertising (4)

- Uncategorised (9)

- Uncategorized (13)

- url shortener (1)

- url shorteners (1)

- vendor (2)

- video (11)

- Video Ads (7)

- Video Advertising (8)

- virtual conference (1)

- we're all just throwing mountains of shit at the wall and hoping the parts that stick don't smell too bad (2)

- web3 (2)

- where you can buy a baby onesie of a dog asking god for his testicles on it (2)

- yes i understand VAST and VPAID (1)

- yes that's the extent of the things i understand (1)

- YouTube (13)

- YouTube Ads (4)

- YouTube Advertising (9)

- YouTube Video Advertising (5)