Social media for banks: 9 tips to boost trust + engagement

If you’re looking to bank social media tips, you’re in the right place.

As a marketer in financial services, navigating bank and credit union social media accounts can be tricky. Balancing compliance regulations with creative content marketing is no small feat. And everything gets even trickier when you’re managing multiple social media channels.

Fortunately, we’ve got some helpful tips to make your job easier. Whether you’re looking for new ways to engage customers on Instagram, build brand awareness on TikTok, or just trying to figure out what tactic will work best on Twitter, these nine tips will help you get started.

Grow your client base with the tool that makes it easy to sell, engage, measure, and win — all while staying compliant.

Why should banks be on social media?

Why do banks need to be on social media? What can social media for banks do for you? Why should you bother with a bank marketing strategy? These are questions with a million answers, but we’ll start with a few.

Social media is among the most used resources for gathering financial information in certain generations

According to the FINRA Foundation, 48% of Gen Z and 42% of millennials report using social media to gather investing and financial information.

Source: FINRA Foundation

While it isn’t the most trusted resource (that one belongs to parents and family), many people turn to social media to discover educational content.

Gen Z uses social media as a way to get financial advice

Generation Z is five times more likely to get financial advice on social media than people 41 and over. Gen Z’s affinity for finfluencers isn’t a surprise. Financial influencers fluent in TikTok know how to deliver content that speaks to this generation.

Your bank social media marketing strategy can take inspiration from their work, creating bite-sized videos focusing on advice or strategy.

Remember, Gen Z is used to getting information quickly and immediately. Booking a call with a financial advisor might not be the best strategy to get them to engage.

@vancitycu So many ways to start investing, but what’s right for you? How are your building wealth? Share your personal tips in the comments. See the full conversation by following the link in our bio. #Investing #personalfinance #investingforbeginners

♬ original sound – Vancity

Your competitors are online

Nine out of 10 banks state that social media is important, and 88% report being very or somewhat active on their accounts.

If you’re not active online, know that your competitors are. And they’re scooping up all your potential social media followers, telling them why their bank is better than yours.

Online FOMO is a big factor in Gen Z investment motivation

Remember when cryptocurrency blew up, and people were making money hand over fist? I do, and I remember feeling a lot of regret for not having invested in it early on.

That kind of FOMO drives Gen Z to invest. In fact, 50% of Gen Z investors report making an investment solely because of FOMO. For those who have, the investment was likely crypto (57%), individual stocks (32%), or meme stocks (28%).

We’re not saying you should entice people to invest in risky businesses like cryptocurrencies. But there’s power in showing a group of people all doing or getting excited about the same thing.

Digital ad spending for the financial sector was $33 billion in 2023

In 2023, the financial sector’s digital ad spend showed an upward trajectory. It’s joining the retail and CPG sectors in surpassing $30 billion in annual spend. According to eMarketer, it will see $36.95 billion in 2025.

When you create your digital strategy, don’t just rely solely on organic social posts. Consider paid advertising efforts like the pros do.

How to do social media for banks: 9 tips

Social media and banking industry haven’t always been the most synonymous of terms. But more and more financial institutions are realizing the benefits of platforms like TikTok, Facebook, and Instagram.

And the more your bank’s online, the more you’re going to realize there are rules to this. Yes, some are concrete, legal rules, but others are more loose social media tips for banks than hard and fast rules.

Here are a few tips to help you kick off your social media strategy.

1. Start with a social media audit

To get a full-picture idea of what you’re working with, do a social media audit. It’s helpful whatever your business size, whether you’re a big global conglomerate, a small mom-and-pop group or anything in between.

If you’re a smaller business, you might need a better picture of what’s working and what’s not.

If you’re a global financial group, you may have multiple accounts spread across social media platforms.

Either way, a social media audit will give you insight into what your brand’s up to on social media.

Global insurance giant MAPFRE, for example, conducted a social media audit and discovered over 80 official accounts spread across different platforms.

@mapfre_es Nada que una videoconsulta con tu vete no pueda resolver

♬ sonido original – MAPFRE EspañaTodo esto y más, con el #Seguro de #Mascotas de MAPFRE. #parati #mascotasentiktok #viral

By consolidating these accounts into one platform using Hootsuite, they gained a clearer view of their social media activity and significantly boosted their online presence.

The results were impressive:

- 2M+ followers on social networks

- 31% increase in online interactions

- 200M+ comments received per year

2. Choose the right platforms

Facebook is used by 95% of the banks surveyed by the American Banker’s Association with LinkedIn coming in at a close second, used by 75% of surveyed banks. Since Facebook and LinkedIn are popular choices, there could be a gap in the market on platforms like TikTok (used by only 7% of banks).

Choosing the right platform depends on who you’re trying to reach.

For example, TikTok is beloved by Gen Z, who prefer bite-sized financial videos over booking an appointment with an advisor.

@vancitycu Pt. 1 Money talk along with some financial tips with @styleisstyle

♬ original sound – VancityFollow along for more of the conversation. #ContentCreators #VancouverBC #Budget

For this generation, phone calls are an extra bit of effort that they don’t have time for. Build trust by meeting them with content they want to consume.

3. Use it to build trust with your audience

Gen Z investors are big on building trust. A FINRA Foundation report states that Gen Z tends to trust sources that give clear explanations with relevant information. (Who doesn’t love that?)

Gen Z also likes commentators who share their own personal financial performance. However, they’re very skeptical about finfluencers who try to sell them something.

The takeaway for banks is that if you partner with a finfluencer, or have your own social media spokespeople on staff, don’t be afraid of getting into personal stories. Also, don’t try to educate and sell in the same breath. No one really wants a sales pitch when they’re gathering information.

Another tactic you can use to build trust is through user-generated content (UGC). Securian Financial‘s #LifeBalanceRemix social media campaign, for example, centered UGC and achieved serious results.

Source: idjhamm on Instagram

Using a mixture of social listening, UGC, and social engagement, the campaign saw:

- 2.5M impressions on Twitter and Instagram

- 1,000+ participants contributing content

- $35,000+ return on investment

4. Be up on your compliance and risk management rules

Where you operate will dictate which compliance and risk management rules you need to follow. Highly regulated industries like finance can face serious risks if compliance isn’t properly managed on social media.

A security breach, whether from unauthorized social media activity or cyber attacks, can result in major financial and reputational damage.

For example, financial technology service provider SIX (operating in Switzerland) manages services for 130 banks. With such a big network, the company is highly susceptible to cyber threats, especially across social media platforms that require constant vigilance.

Source: sixgroup on Instagram

To combat this, SIX implemented automated cyber security measures (powered in part by Hootsuite) to monitor and address threats, such as unauthorized profiles or malicious content.

The results speak for themselves:

- 30-40 automated alerts generated per month

- 1-2 non-compliant content takedowns a month made possible

- < 24 hour content takedown time achieved

And speaking of compliance: We’ve already mentioned FINRA a few times, so here are some tips to stay compliant with them and tips on staying compliant with the SEC on social media.

5. Educate your internal team on your compliance and strategy

Include a phase in your social media strategy dedicated to educating your internal team on your industry’s regulations and your own social media guidelines.

If your team members understand what compliance looks like, they will be far less likely to accidentally post something that may get you in trouble.

Hootsuite can also make this easier. Amplify, our employee advocacy platform, allows content admins to push a steady stream of pre-approved, curated content that your employees can share on their social accounts.

Amplify’s a great way to extend your organization’s reach while reducing risk with on-brand, compliant content. We use it ourselves, and we’ve also introduced an educational component into the strategy.

After implementing Amplify, we saw impressive results:

- 250% YOY increase in sourced revenue

- 80% Amplify sign-up rate—up 9% YOY

- 4.1M employer brand impressions in Q1 attributed to employee posts via Amplify

6. Have a social media governance policy in place

A social media governance policy lays out the rules of engagement for all employees. This can be a document outlining all of the ‘needs to know’ for your content creators.

Your policy should align with your guidelines for email, text, and all other communications with clients and the public. Overall, it will help you operate within your industry’s regulations.

Since social media management is part of the company’s overall security and compliance policies, the chief information officer and chief risk officer may be involved in creating your social media governance policy.

Hootsuite can even partner with you to deliver custom social media governance training for your employees.

7. Use social media as one piece of your greater marketing strategy

Investors in younger generations (aged 18-34) aren’t exclusively relying on social media for financial advice. They use it in conjunction with other sources to gather information.

Source: vancitycu on Instagram

So, creating a network of digital information (like linking your social posts back to your blog and from your blog to vetted sources) will help you build a reliable reputation. This can be as simple as adding a CTA like “click the link in our bio.”

8. Humanize your brand with people-forward content

People content on a financial brand’s social media page typically does really well. Bank marketing executives polled in an ABA report unanimously agreed that audiences appreciate learning about the bank’s people.

You can improve your social media engagement by posting about the people within your company. Share employee stories, your client’s experiences and testimonials, and behind-the-scenes updates.

You’ll give off the impression that you care about the people who work within your organization, which is important in an industry often seen as impersonal.

Source: holidayheroesfoundation on Instagram

Your efforts to humanize your brand will pay off. For example, Armanino LLP, a top 20 CPA and consulting firm, used Hootsuite Amplify to empower employees as brand ambassadors.

This boosted the firm’s reach and reputation with:

- 14,707 website clicks from employee posts

- 19.2M people reached with employee content (+638% year-over-year)

- $232,375 in potential ad value created through employee advocacy

9. Engage with your audience

The beautiful thing about social media is that it’s a two-way street. People are reaching out to you who want to engage, to have a conversation.

Good customer service isn’t just about fielding complaints, either. Being open and receptive to talking with your audience humanizes your institution and helps build customer loyalty.

Source: Vancity on Threads

Respond to tweets and threads, engage with comments on Instagram, TikTok, and LinkedIn, and be sure to message back on Messenger.

Get a glimpse into the future of financial services on social media and build a strategy you can bank on.

Get the reportSocial media and banking: how to measure success

Success isn’t just about likes and follows. Financial institutions need to approach social media with a strategic mindset, focused on the right metrics and using the best tools to track, analyze, and adapt.

Setting your social media goals will give you insight into what you need to look for to determine your success.

Use the right tool

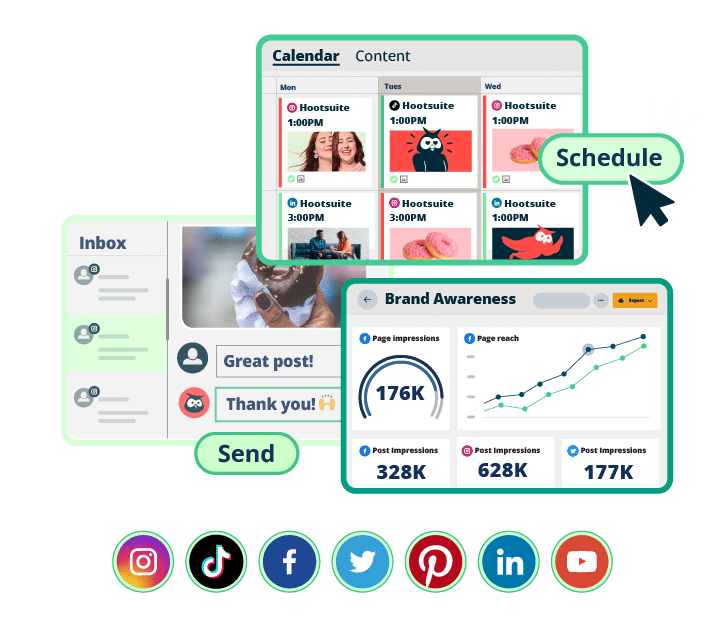

The right tool can take your social strategy from basic to bossy. Not to brag (but to brag a little), Hootsuite’s all-in-one solution helps credit unions, banks, and other financial institutions measure and manage every aspect of their social media presence.

You can get help with scheduling, reporting, and creating compliance content for credit unions and banks, or whatever else your heart desires.

Hootsuite Analytics will give you an overall view of what’s working and what’s not in your strategy, but there are other features the financial sector loves:

- Scheduling: Plan posts across multiple platforms to stay consistent. You can reach your audience at optimal times using our Best Time to Publish tool, even across different time zones.

- Benchmarking: Compare your performance against competitors and industry standards to see where you stand. You can do this using Hootsuite Analytics or check out our complete guide to social media benchmarks for financial services (it’s updated quarterly!).

- Social listening: Monitor what people are saying about your brand, competitors, and industry trends in real time. This helps you stay proactive in managing your reputation and addressing concerns before they escalate.

- Community management: Hootsuite allows you to manage customer inquiries and responses from one dashboard, helping you with consistent communication.

- Compliance and risk management: Hootsuite’s monitoring tools ensure that your content stays compliant with financial regulations while protecting your brand from cyber threats.

Track the right metrics

To gauge the effectiveness of your social media efforts, focus on key performance indicators (KPIs) that align with your business goals.

Here are a few popular metrics you might want to consider:

- Engagement rates: Likes, comments, shares, and mentions. If you need a quick reference, bookmark this page for quarterly updates on the average engagement rates for financial services.

- Reach and impressions: How far your content is spreading and how many people are seeing it.

- Conversion rates: The percentage of social media interactions that lead to a desired action, like clicking a link or signing up for a service.

- Customer sentiment: Measure how people feel about your brand through comments, reviews, and social mentions.

Review results and adapt your strategy

The social strategies that work are the ones that are regularly reviewed and adapted. Take a look at your metrics using Hootsuite Analytics to see what’s working and what’s not, and adjust your budget and strategy accordingly.

If a particular type of content performs better, lean into that. If engagement drops, reassess your approach. Your data is going to be the best indicator of what’s working and what’s not, letting you adjust your strategy for the best results and best use of your social media budget.

Hootsuite makes social marketing easy for financial service professionals. Manage all your networks, drive revenue, provide customer service, mitigate risk, and stay compliant — all from one easy-to-use dashboard. See the platform in action.

Get more leads, engage customers and stay compliant with Hootsuite, the #1 social media tool for financial services.

Book a DemoThe post Social media for banks: 9 tips to boost trust + engagement appeared first on Social Media Marketing & Management Dashboard.

Categories

- 60% of the time… (1)

- A/B Testing (2)

- Ad placements (3)

- adops (4)

- adops vs sales (5)

- AdParlor 101 (43)

- adx (1)

- AI (10)

- algorithm (1)

- Analysis (14)

- Apple (1)

- Audience (1)

- Augmented Reality (1)

- authenticity (1)

- Automation (1)

- Back to School (1)

- best practices (2)

- brand voice (1)

- branding (1)

- Build a Blog Community (12)

- Calculator (2)

- Case Studies (2)

- Case Study (3)

- celebrate women (1)

- certification (1)

- Collections (1)

- Community (1)

- Conference News (2)

- conferences (1)

- confluence (1)

- content (1)

- content creation (67)

- Content creators (9)

- content curation (1)

- content marketing (3)

- contests (1)

- Conversion Lift Test (1)

- Conversion testing (1)

- cost control (2)

- Creative (6)

- crisis (1)

- Curation (1)

- Custom Audience Targeting (4)

- Customer service (11)

- Digital Advertising (2)

- Digital Marketing (6)

- does DCM charge you by the report? (1)

- DPA (1)

- Dynamic Ad Creative (1)

- dynamic product ads (1)

- E-Commerce (1)

- eCommerce (2)

- Education (2)

- email marketing (3)

- Employee advocacy (3)

- employee advocacy program (1)

- employee advocates (1)

- engineers (1)

- event marketing (1)

- event marketing strategy (1)

- events (3)

- Experiments (40)

- F8 (2)

- Facebook (64)

- Facebook Ad Split Testing (1)

- facebook ads (18)

- Facebook Ads How To (1)

- Facebook Advertising (30)

- Facebook Audience Network (1)

- Facebook Creative Platform Partners (1)

- facebook marketing (1)

- Facebook Marketing Partners (2)

- Facebook Optimizations (1)

- Facebook Posts (1)

- facebook stories (1)

- Facebook Updates (2)

- Facebook Video Ads (1)

- Facebook Watch (1)

- fbf (11)

- feels good to be back (1)

- Financial services (3)

- first impression takeover (5)

- fito (5)

- Fluent (1)

- Free tool (4)

- Get Started With Wix Blog (1)

- Google (9)

- Google Ad Products (5)

- Google Analytics (1)

- Government (4)

- Guest Post (1)

- Guide (12)

- Guides (32)

- Halloween (1)

- Healthcare (2)

- holiday marketing (1)

- Holiday Season Advertising (7)

- Holiday Shopping Season (4)

- Holiday Video Ads (1)

- holidays (4)

- Hootsuite How-To (3)

- Hootsuite HQ (1)

- Hootsuite Life (1)

- how to (6)

- How to get Instagram followers (1)

- How to get more Instagram followers (1)

- i don't understand a single thing he is or has been saying (2)

- i’ll take ‘things that’ve never happened’ for $1000 (1)

- if you need any proof that we're all just making it up (2)

- Incrementality (1)

- influencer marketing (3)

- Infographic (1)

- Instagram (39)

- Instagram Ads (11)

- Instagram advertising (8)

- Instagram best practices (1)

- Instagram followers (1)

- Instagram Partner (1)

- Instagram Stories (2)

- Instagram tips (1)

- Instagram Video Ads (2)

- invite (1)

- Landing Page (1)

- Legal (1)

- link shorteners (1)

- LinkedIn (22)

- LinkedIn Ads (2)

- LinkedIn Advertising (2)

- LinkedIn Stats (1)

- LinkedIn Targeting (5)

- Linkedin Usage (1)

- List (1)

- listening (2)

- Lists (3)

- Livestreaming (1)

- look no further than the new yorker store (2)

- lunch (1)

- Mac (1)

- macOS (1)

- Marketing to Millennials (2)

- mental health (1)

- metaverse (2)

- mobile (2)

- Mobile App Marketing (3)

- Monetizing Pinterest (2)

- Monetizing Social Media (2)

- Monthly Updates (10)

- Mothers Day (1)

- movies for social media managers (1)

- new releases (11)

- News (80)

- News & Events (11)

- no one knows what they're doing (2)

- Non-profit (2)

- OnlineShopping (2)

- or ari paparo (2)

- owly shortener (1)

- Paid Media (2)

- People-Based Marketing (3)

- performance marketing (5)

- Pinterest (34)

- Pinterest Ads (11)

- Pinterest Advertising (8)

- Pinterest how to (1)

- Pinterest Tag helper (5)

- Pinterest Targeting (6)

- platform health (1)

- Platform Updates (8)

- Press Release (2)

- product catalog (1)

- Productivity (10)

- Programmatic (3)

- quick work (1)

- Real estate (5)

- Reddit (3)

- reels (1)

- Report (2)

- Reporting (1)

- Resources (27)

- ROI (1)

- rules (1)

- sales heart grew three times that day (1)

- Seamless shopping (1)

- share of voice (1)

- Shoppable ads (4)

- short-form video (2)

- shorts (2)

- Skills (25)

- SMB (1)

- SnapChat (28)

- SnapChat Ads (8)

- SnapChat Advertising (5)

- Social (145)

- social ads (1)

- Social Advertising (14)

- Social commerce (7)

- social customer service (1)

- Social Fresh Tips (2)

- Social listening (11)

- Social Media (5)

- Social Media Advertising (18)

- Social media analytics (34)

- social media automation (1)

- Social media benchmarks (2)

- Social media career (2)

- social media content calendar (1)

- Social media content creation (3)

- Social media engagement (15)

- social media for events (1)

- social media management (2)

- Social Media Marketing (49)

- social media monitoring (1)

- Social Media News (4)

- Social media scheduling (22)

- social media statistics (1)

- Social media stats (25)

- Social Media Strategy (161)

- social media tools (66)

- social media tracking in google analytics (1)

- Social media trends (14)

- social media tutorial (2)

- Social Toolkit Podcast (1)

- Social Video (32)

- stories (1)

- Strategy (1)

- Strategy (922)

- Teamwork (3)

- Template (21)

- terms (1)

- Testing (2)

- there are times ive found myself talking to ari and even though none of the words he is using are new to me (2)

- they've done studies (1)

- this is also true of anytime i have to talk to developers (2)

- tiktok (14)

- tool (1)

- tools (1)

- Topics & Trends (3)

- Trend (12)

- Twitter (15)

- Twitter Ads (5)

- Twitter Advertising (4)

- Uncategorised (9)

- Uncategorized (13)

- url shortener (1)

- url shorteners (1)

- vendor (2)

- video (14)

- Video Ads (7)

- Video Advertising (8)

- virtual conference (1)

- we're all just throwing mountains of shit at the wall and hoping the parts that stick don't smell too bad (2)

- web3 (2)

- whats the point in weekly reports? (1)

- where you can buy a baby onesie of a dog asking god for his testicles on it (2)

- why is this so fucking hard (1)

- yes i understand VAST and VPAID (2)

- yes that's the extent of the things i understand (2)

- you have a 10 day campaign (1)

- YouTube (13)

- YouTube Ads (4)

- YouTube Advertising (9)

- YouTube Video Advertising (5)